Marketing Spend vs Revenue Growth in Accounting Firms: What Partners Should Really Track

The relationship between marketing spend vs revenue growth in accounting firms is often misunderstood. Many partners expect a direct, linear outcome: spend more on marketing, and revenue should increase accordingly. When this does not happen, marketing is often blamed or cut.

In reality, accounting firms do not grow like consumer businesses. Revenue growth depends on trust, conversion quality, service capacity, and long sales cycles. As a result, tracking the wrong metrics leads partners to make the wrong decisions.

This article explains why marketing spend does not translate neatly into revenue growth, and what partners should really track instead.

Why Revenue Growth Lags Marketing Spend in Accounting Firms

Accounting firms operate very differently from transactional businesses.

Typically:

-

Clients take months to decide

-

Engagements start small and grow over time

-

Conversions often happen offline

-

Referrals play a major role

Therefore, marketing spend often shows impact before revenue appears — but not in obvious financial statements.

Partners who expect immediate revenue uplift usually misread marketing performance.

The Most Common Partner Mistake: Tracking Revenue Too Early

Many partners review marketing performance by asking:

“How much revenue did this campaign bring in last month?”

This question is understandable — but flawed.

Marketing spend often:

-

Generates awareness first

-

Supports future referrals

-

Improves conversion quality later

As a result, short-term revenue tracking undervalues marketing contribution.

Why “Revenue per Dollar Spent” Is a Misleading Metric

Direct revenue attribution works well for:

-

E-commerce

-

Lead-gen funnels with instant conversion

However, for accounting firms:

-

One enquiry may convert months later

-

One client may come via multiple touchpoints

-

One campaign may support referrals, not direct leads

Therefore, revenue per dollar spent oversimplifies reality and encourages short-term thinking.

What Partners Should Track Instead

1️⃣ Quality of Enquiries (Not Volume)

Partners should track:

-

Enquiries that fit target client profiles

-

Industry relevance

-

Required service type

Ten low-quality leads waste more partner time than one strong enquiry. Marketing that improves lead quality is working — even if volume is lower.

2️⃣ Lead-to-Client Conversion Rate

This KPI shows whether marketing is attracting the right prospects.

Low conversion may indicate:

-

Poor targeting

-

Weak trust signals

-

Misaligned messaging

Improving conversion rate often drives more growth than increasing spend.

3️⃣ Revenue per New Client (By Source)

Not all revenue is equal.

Partners should compare:

-

Average first-year fees

-

Service mix

-

Upsell potential

Clients acquired through thought leadership often generate higher long-term value than price-driven leads.

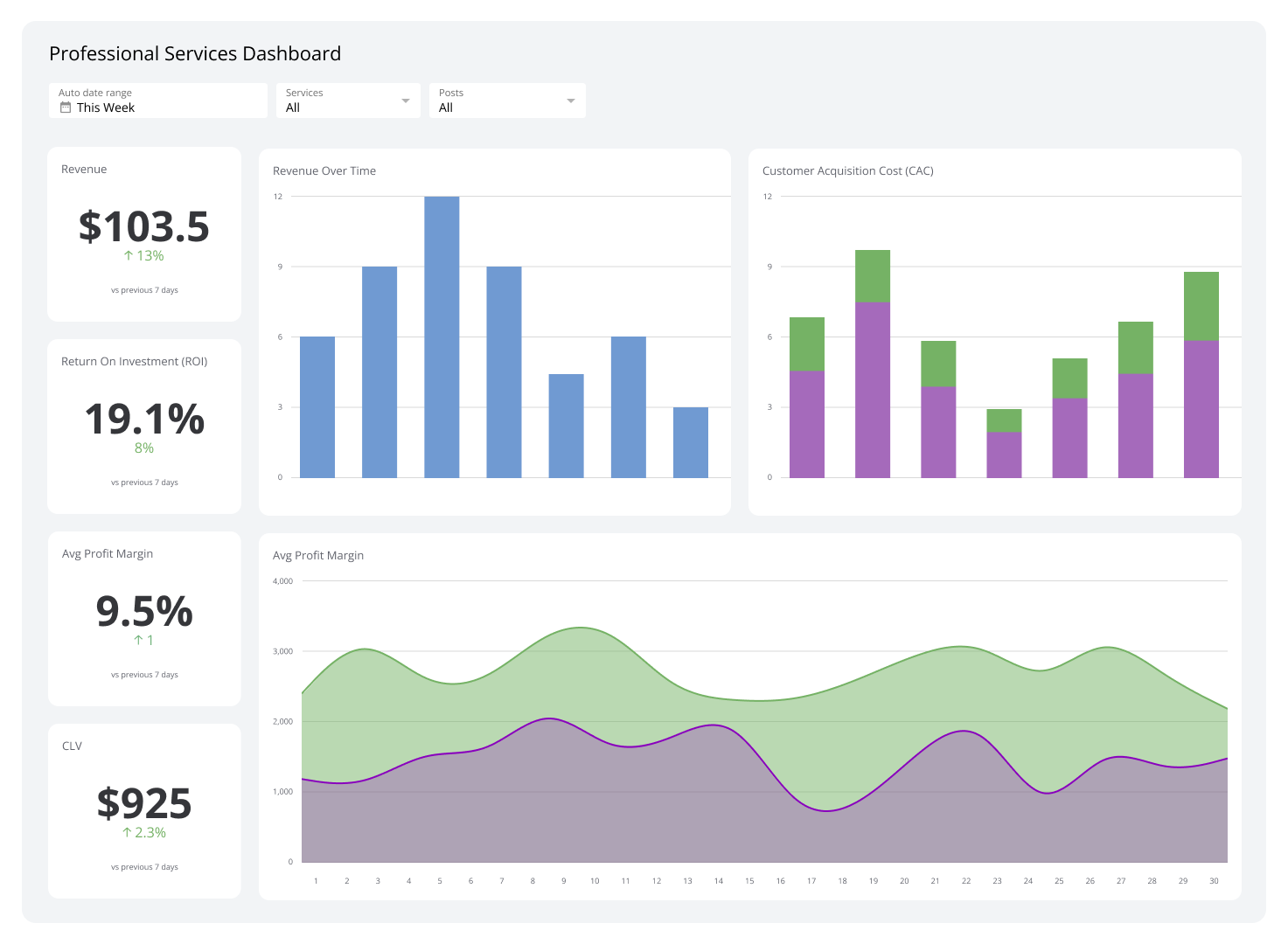

4️⃣ Client Lifetime Value (CLV)

CLV matters far more than first-year revenue.

Accounting firms rely on:

-

Recurring compliance work

-

Cross-sell and upsell

-

Long client relationships

Marketing spend should be evaluated against expected lifetime value, not initial fees.

5️⃣ Sales Cycle Length

Tracking how long it takes from:

first contact → signed engagement

helps partners:

-

Set realistic expectations

-

Forecast revenue timing

-

Understand marketing’s supporting role

A shorter sales cycle often reflects better trust and positioning.

6️⃣ Capacity Utilisation and Bottlenecks

Marketing may be “working” even when revenue stalls — if the firm lacks capacity.

Partners should monitor:

-

Staff utilisation

-

Partner availability

-

Onboarding bottlenecks

Without delivery capacity, revenue growth will lag regardless of marketing spend.

7️⃣ Assisted Conversions (Often Ignored)

Many clients:

-

See the firm online

-

Then ask a friend

-

Then contact the firm directly

If marketing is not tracked as an assist, partners may undervalue its contribution.

Simple methods include:

-

Asking new clients how they heard about the firm

-

Tracking branded search growth

-

Reviewing repeat exposure patterns

What Partners Should Stop Tracking Obsessively

Some metrics matter less than partners think:

-

Raw website traffic

-

Social media likes

-

Click-through rates alone

-

Cost per click without context

These metrics indicate visibility, not growth.

Aligning Marketing Spend With Firm Strategy

Marketing spend should reflect where the firm wants to grow.

For example:

-

Audit-focused firms should track different metrics than SME compliance firms

-

Advisory-led firms should prioritise CLV and revenue per client

-

Growth-stage firms may accept longer payback periods

Without alignment, spend feels wasteful even when it is strategic.

A Practical Partner-Level Framework

Instead of asking:

“Did marketing bring revenue this quarter?”

Partners should ask:

-

Are we attracting better-fit clients?

-

Are conversion rates improving?

-

Is average client value rising?

-

Is our pipeline healthier than last year?

If the answers are yes, marketing is contributing to growth — even if revenue lags temporarily.

Marketing Spend as a Risk-Reduction Tool

Marketing also reduces risk by:

-

Building brand credibility

-

Supporting referrals

-

Improving perceived professionalism

These benefits rarely appear in revenue reports but strongly influence client decisions.

Final Thoughts

The link between marketing spend vs revenue growth in accounting firms is indirect, delayed, and often misunderstood.

Partners who focus only on short-term revenue miss the bigger picture. Firms that track lead quality, conversion, CLV, and capacity alignment make better decisions and achieve more sustainable growth.

Marketing should be judged as a strategic investment, not a monthly expense.

How uSafe Can Help

uSafe works with accounting and professional firms to:

-

Align marketing metrics with partner expectations

-

Build CLV-based ROI models

-

Improve lead quality and conversion

-

Support sustainable revenue growth

If your firm spends on marketing but struggles to link it to growth, we can help clarify what really matters.