How to Prepare for Your First Audit: A CFO-Level Checklist

Preparing for your first audit can feel overwhelming — especially for CFOs and founders who have never gone through the process before. Many companies assume that an audit is simply a year-end check of numbers. In reality, first-time audits test systems, documentation, controls, and management discipline.

Companies that prepare late often face delays, audit adjustments, higher fees, and unnecessary stress. On the other hand, companies that prepare early usually experience smoother audits and stronger outcomes.

This article provides a CFO-level checklist to help you prepare for your first audit properly, not just pass it.

Why First Audits Are Different

First audits are more demanding because:

-

There is no prior-year audited baseline

-

Processes may be undocumented

-

Controls may exist informally

-

Historical errors surface for the first time

As a result, auditors apply more extensive procedures. Preparation therefore matters more than in subsequent years.

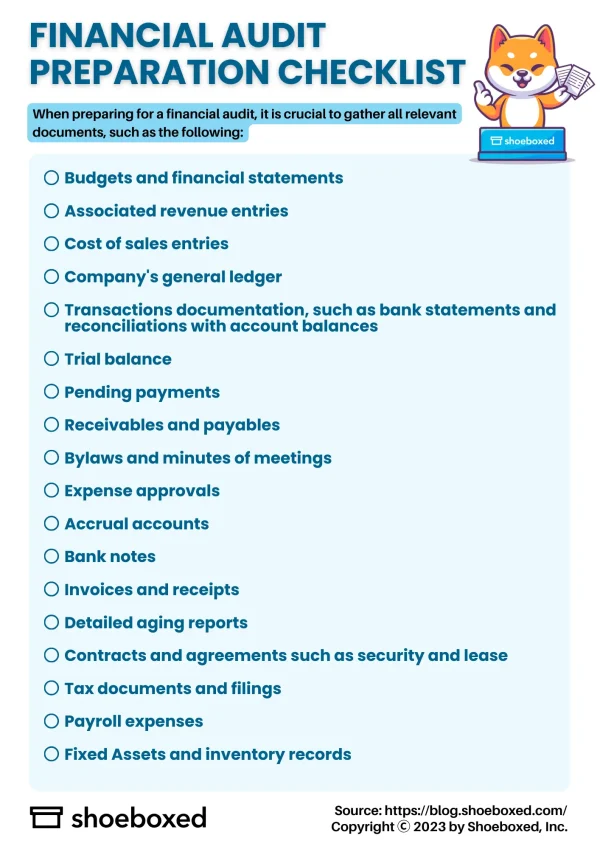

CFO-Level First Audit Preparation Checklist

1️⃣ Confirm Whether an Audit Is Required

Before doing anything else, confirm why an audit applies.

In Singapore, audits are typically required when:

-

The company does not qualify for audit exemption

-

Banks or investors require audited financials

-

Group consolidation rules apply

Audit obligations are regulated by the Accounting and Corporate Regulatory Authority. Confirming this early avoids unnecessary work or incorrect filings.

2️⃣ Lock Down the Financial Statements Early

Auditors do not audit drafts endlessly.

Before audit fieldwork:

-

Finalise the trial balance

-

Resolve suspense and clearing accounts

-

Ensure journals are reviewed and approved

Frequent post-audit adjustments are a red flag and slow the process significantly.

3️⃣ Reconcile All Key Balances (Non-Negotiable)

Unreconciled balances are the number one cause of audit delays.

Ensure reconciliations exist for:

-

Bank accounts

-

Trade receivables and payables

-

Intercompany balances

-

Director and shareholder accounts

-

Accruals and prepayments

Each reconciliation should be dated, reviewed, and supported.

4️⃣ Prepare Supporting Schedules in Advance

Auditors expect structured schedules — not raw data dumps.

Common schedules include:

-

Fixed asset register and depreciation

-

Revenue breakdown by type

-

Expense analysis

-

Related party transaction listing

Preparing these early reduces back-and-forth queries.

5️⃣ Review Revenue Recognition Carefully

Revenue is one of the highest-risk audit areas.

CFOs should ensure:

-

Revenue aligns with contracts and delivery

-

Cut-off is applied correctly

-

One-off income is clearly identified

Errors here often lead to audit adjustments and questions from the Inland Revenue Authority of Singapore later.

6️⃣ Clean Up Director & Related Party Accounts

First audits frequently uncover issues in:

-

Director loan balances

-

Related party transactions

-

Informal reimbursements

Ensure:

-

Balances are explainable

-

Agreements exist where required

-

Disclosures are complete

These areas attract heightened auditor scrutiny.

7️⃣ Document Key Processes (Even If Informal)

Auditors assess internal controls — even in SMEs.

At minimum, document:

-

Who approves payments

-

Who prepares and reviews accounts

-

How revenue and expenses are authorised

Simple process documentation is far better than none.

8️⃣ Prepare Audit-Ready Documentation

Auditors value clarity and organisation.

Before fieldwork:

-

Centralise documents in a shared folder

-

Label files clearly

-

Avoid last-minute scrambling

Well-organised documentation reduces audit hours and fees.

9️⃣ Align Audit and Tax Positions Early

Audit and tax should tell the same story.

CFOs should check:

-

Accounting treatments align with tax filings

-

Significant adjustments are explained

-

Deferred tax implications are understood

Misalignment often triggers additional questions and revisions.

🔟 Brief Management and Directors

Auditors may speak to:

-

Directors

-

CFOs

-

Senior managers

Ensure management understands:

-

Key accounting judgments

-

Major changes from prior years

-

Unusual transactions

Consistency matters. Conflicting explanations slow audits and raise concerns.

Common First-Audit Mistakes CFOs Should Avoid

-

Waiting until auditors ask for documents

-

Treating the audit as “just compliance”

-

Underestimating documentation requirements

-

Leaving reconciliations until year-end

-

Assuming auditors will “figure it out”

Auditors audit evidence — not assumptions.

What a Well-Prepared First Audit Looks Like

When preparation is done properly:

-

Audit timelines shorten

-

Fewer adjustments arise

-

Fees stay predictable

-

Management credibility improves

More importantly, the company emerges with stronger financial discipline.

First Audit as a Governance Milestone

A first audit is not just a hurdle — it is a governance milestone.

It signals:

-

Business maturity

-

Readiness for investors or banks

-

Stronger internal discipline

Companies that embrace the process usually benefit long after the audit is completed.

Final Thoughts

To prepare for your first audit, CFOs must think beyond numbers. Preparation involves controls, documentation, alignment, and communication.

Companies that treat the first audit seriously avoid surprises and build long-term credibility. Those that rush it often pay more — in cost, time, and stress.

How uSafe Can Help

uSafe supports companies with:

-

First-audit readiness reviews

-

Accounting clean-ups before audit

-

CFO-level audit preparation checklists

-

Liaison with auditors and tax agents

If your company is approaching its first audit, early preparation makes all the difference.