What Happens If You Ignore IRAS Letters? A Step-by-Step Reality Check

Many business owners underestimate the consequences when they ignore IRAS letters. At first, an IRAS notice may look routine or harmless. However, once deadlines pass, matters can escalate quickly.

In Singapore, tax compliance is taken seriously. Therefore, ignoring correspondence from the Inland Revenue Authority of Singapore rarely ends well. This article explains what happens step by step if IRAS letters are ignored — and what you should do instead.

Why IRAS Letters Matter

IRAS letters are not casual reminders. Instead, they are formal communications issued under Singapore tax law.

Typically, IRAS writes to request:

-

Clarification on tax filings

-

Submission of missing returns

-

Supporting documents

-

Payment of outstanding tax

Once a letter is issued, IRAS expects a response by the stated deadline. Ignoring it signals non-compliance, even if the issue started as a simple oversight.

IRAS Revenue Collection: Supporting Singapore’s Growth with Responsible Taxation

Common Types of IRAS Letters

Before escalation, IRAS usually issues one of the following:

-

Notices to file tax returns (ECI, Form C / C-S)

-

Requests for information or clarification

-

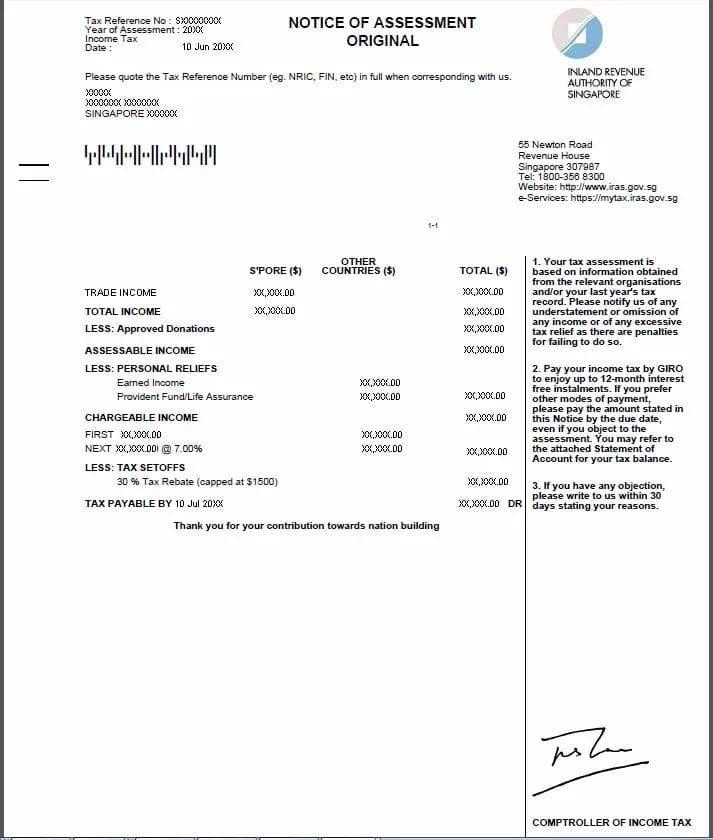

Notices of assessment

-

Payment reminders

Many taxpayers delay because they feel unsure how to respond. Unfortunately, silence makes the situation worse.

What Happens If You Ignore IRAS Letters? Step by Step

Step 1️⃣ Reminder Notices Are Issued

Initially, IRAS sends reminder letters if there is no response.

At this stage:

-

No penalties may apply yet

-

IRAS assumes the delay may be unintentional

However, deadlines still apply. Each reminder reduces flexibility.

Step 2️⃣ IRAS Issues an Estimated Assessment

If filings remain outstanding, IRAS may issue an estimated Notice of Assessment (NOA).

This means:

-

IRAS estimates your taxable income

-

The estimate is often higher than actual income

-

Tax becomes payable immediately

Importantly, estimated assessments remain valid until formally objected to. Simply disagreeing informally is not enough.

Step 3️⃣ Late Filing Penalties Are Imposed

Next, IRAS may impose late filing penalties.

These may include:

-

Composition sums

-

Fixed monetary penalties

-

Additional charges for continued non-compliance

At this point, costs increase even if the underlying tax is small.

Step 4️⃣ Enforcement Actions Begin

If payment or response still does not occur, IRAS can escalate enforcement.

Possible actions include:

-

Issuing a demand notice

-

Appointing agents (e.g. banks) to recover tax

-

Offsetting refunds against outstanding tax

For companies, enforcement may also affect directors personally.

Step 5️⃣ Summons and Court Action

Continued non-response can lead to court proceedings.

This may involve:

-

Summons to attend court

-

Fines imposed by the court

-

Further penalties

At this stage, matters become public record and reputational damage may occur.

Step 6️⃣ Director Exposure and Business Disruption

For companies, ignoring IRAS letters may expose directors to:

-

Legal liability

-

Travel restrictions in severe cases

-

Difficulty obtaining financing

-

Problems with future audits or restructuring

In extreme situations, unresolved tax issues can delay corporate actions such as strike-off or liquidation.

Why Businesses Ignore IRAS Letters (And Why That’s Risky)

Common reasons include:

-

Uncertainty about how to respond

-

Incomplete records

-

Disputes with accountants

-

Cash flow pressure

However, IRAS is generally more flexible when taxpayers engage early. Silence removes that flexibility.

What You Should Do If You Receive an IRAS Letter

Respond Early — Even If You Need Time

Acknowledging receipt buys time and shows good faith.

Seek Professional Advice

Tax agents can clarify issues and handle correspondence properly.

Submit Corrective Filings Promptly

Late but accurate filings often reduce penalties.

Avoid Repeated Non-Response

Repeated silence signals intentional non-compliance.

Guidance on statutory compliance expectations can also be found through official regulator resources.

Sources: https://www.iras.gov.sg/taxes

Can Penalties Be Reduced?

In many cases, yes.

IRAS may consider:

-

Voluntary disclosure

-

Genuine errors

-

Cooperation and prompt correction

However, penalty mitigation usually depends on early engagement, not late reaction.

Strengthen Your GST Compliance with IRAS’s Self-Review Tools

Ignoring IRAS Letters vs Engaging Early

| Action | Outcome |

|---|---|

| Ignore IRAS letters | Escalation, penalties, enforcement |

| Respond early | Higher chance of resolution |

| Seek professional help | Lower risk and clearer strategy |

The difference often lies in timing, not intent.

Final Thoughts

Ignoring IRAS letters is rarely a harmless delay. Instead, it sets off a chain of events that becomes harder and more costly to reverse.

By responding early, seeking advice, and addressing issues promptly, most tax matters can be resolved without serious consequences.

How uSafe Can Help

uSafe assists businesses with:

-

Responding to IRAS letters

-

Tax clarification and negotiation

-

Corrective filings

-

Ongoing compliance management

If you have received an IRAS letter and are unsure how to respond, speak with us early to avoid escalation.